Excessive tax rebate has a spectrum? Participants and the Ministry of Finance have a wide gap

The collaborative meeting discussed the issue of over-levy, but the gap between the proposal and the Ministry of Finance was wide. The two sides exchanged fires several times, and it was difficult for the collaborative meeting to enter the afternoon group discussion. Under limited time, the two sides could only be sorted out and provided for follow-up. reference.

On April 20th, the Ministry of Finance and the PDIS Group held the Excessive Collection of Taxes - Return to the People at the Information Center of the Ministry of Finance " Collaborative meeting in the case.

This case was reached by Jenny Wang on February 4, 2018, and reached the threshold of 5,000 on February 25th. After the vote of the Open Government Liaison Meeting, the Ministry of Finance and the PDIS team will hold it together. In the proposal, the proponent suggested that the Ministry of Finance should amend the law to distribute the excess tax collected on average to the taxpayer or to offset the tax payable for the next year. She believes that such a proposal can stimulate consumption and promote economic development. However, the Ministry of Finance does not believe that such a statement is reasonable.

Collaboration meeting attendees are not familiar

At the beginning of the day's meeting, Wu Jingqin, the teacher at the meeting, kept on raising procedural issues. He believed that the meeting did not submit information in advance about one week. He was given the feeling of "raid"; although he had a mental map at the meeting, he thought that the mind map was difficult to understand and should provide clerical information for pre-reading. In terms of numbers, he believes that there are more officials on the scene than the people. "It seems that it is not going to listen to the public opinion." He worried that "the people will have no voice" and therefore protested many times.

The host team, although explained, the choice of the participants is not based on the number of people, but the participants are expected to present multiple opinions as much as possible, so there are some restrictions on the number of people. However, Wu Jingqin did not accept the teacher and still thought that there were problems in the procedure.

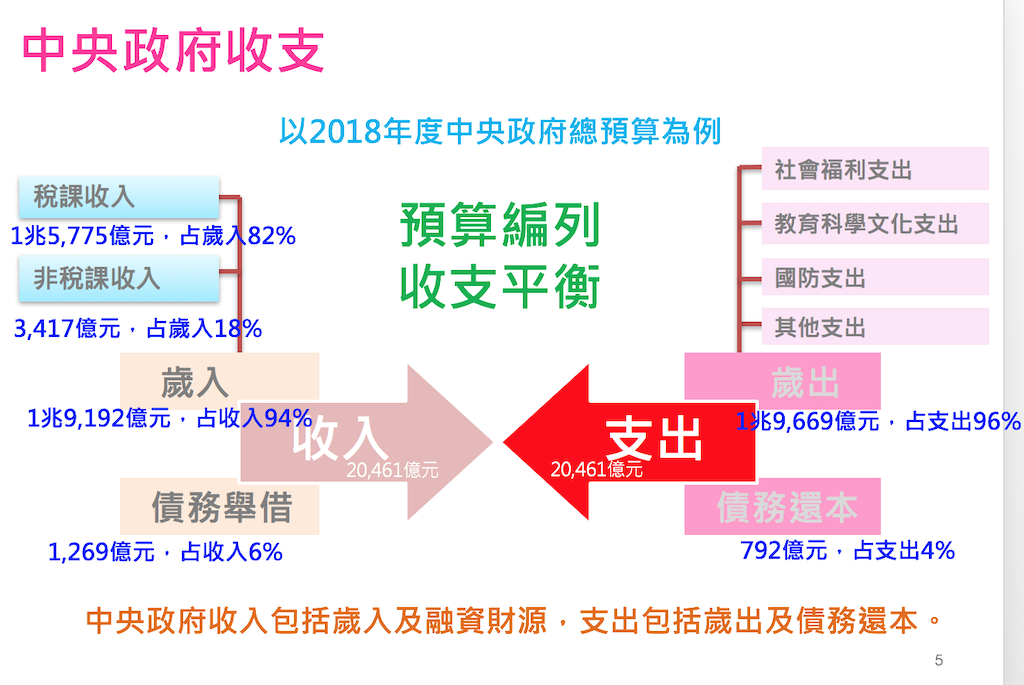

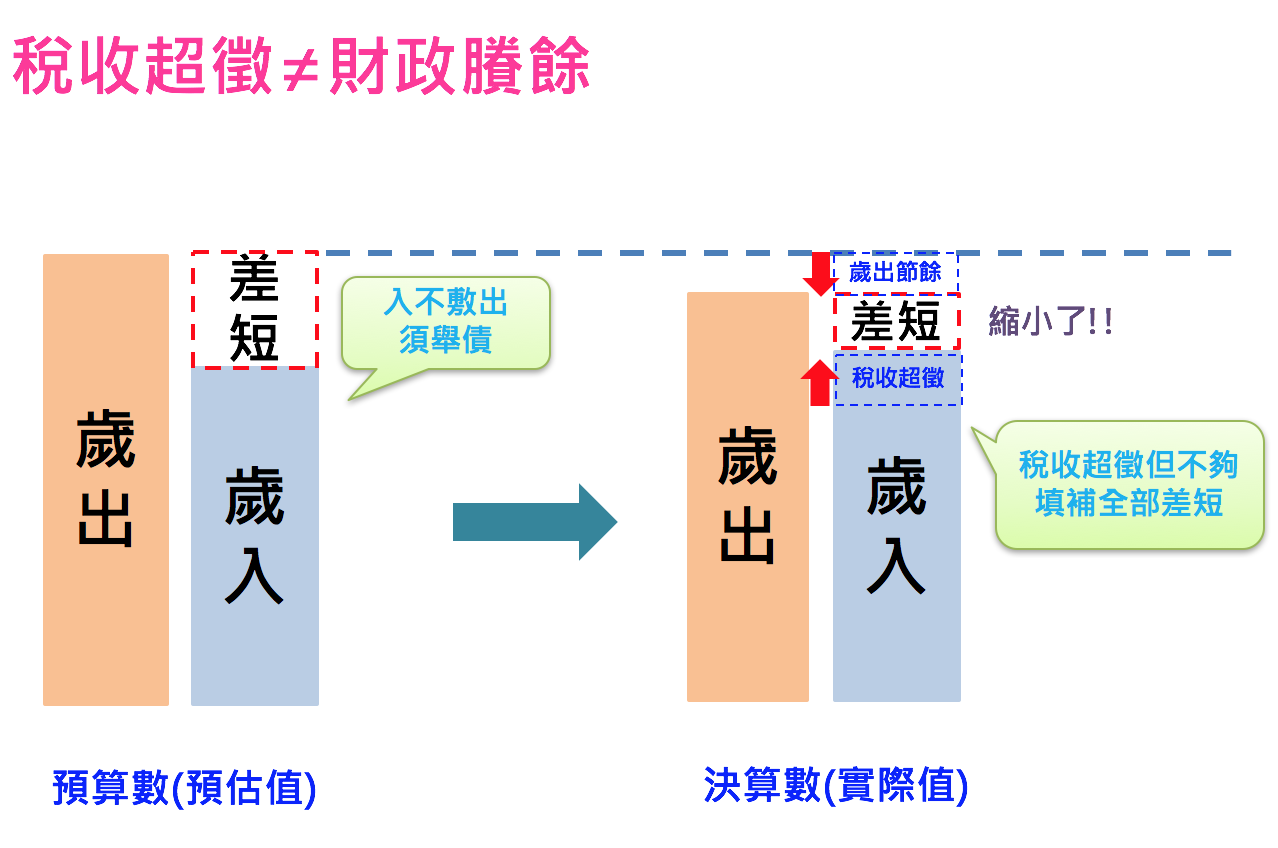

The Ministry of Finance explained that the budget is only an estimate

Because the sponsor of the meeting was not present, it was customary to explain it by the Ministry of Finance. The Ministry of Finance pointed out that China's fiscal operation is to estimate the "year-out" of state expenditure at the beginning of the year and the "year-end" that may be received this year. However, this is only an estimate. At the end of the year, when calculating the actual value, there may be a gap with the estimate. If the actual annual income is less than the estimated annual income, it is called "short-term". If the actual annual income is greater than the estimated annual income, it is called "super-levy", but the super-levy and short-term sign are not related to the annual income, that is, even if the annual income is Over-levy, the annual income may also be much higher than the actual annual income, leading to the country's fiscal still deficit.

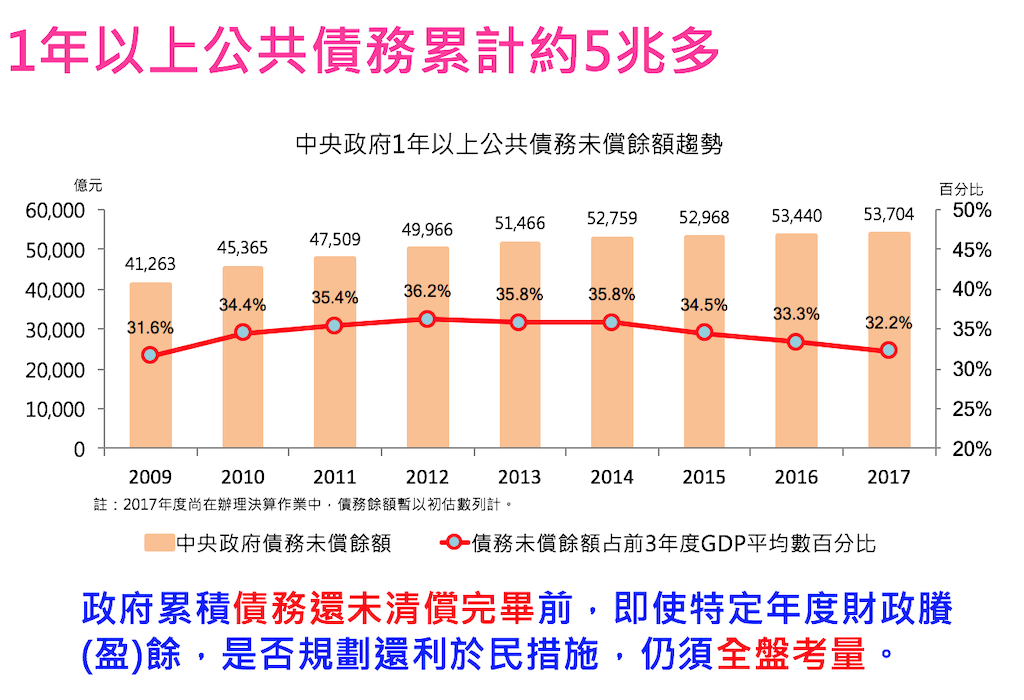

The Ministry of Finance pointed out that the number of debt borrowings in the year will depend on the status of annual revenue and annual execution. As the past few years have exceeded, the rate of increase in government debt has continued to slow down. That is to say, since the actual annual output is higher than the actual annual income in recent years, how much money is over-levied, and the amount will be borrowed less in the year. In the follow-up explanation, Teacher Chen Guoliang added that if the people hope that these amounts will be refunded to the people, then the government will have to borrow extra money. I am afraid that there will be a situation of "intergenerational plundering", that is, taking money from the pockets of future generations and returning taxes.

For the proponent's argument that "super levy should be refunded to the people", the Ministry of Finance explained that most of the countries that can benefit the people are financially well-received, and the annual income is greater than the annual income and there is a fiscal surplus, so the tax can be refunded. . Even if it is beneficial to the people or tax rebate to revitalize the economy, it must be included in the budget of the next year. After the review by the Legislative Yuan, the tax can be refunded. Moreover, the current status of the super-levy is different. If the consumption tax is excessive, it is difficult. Know who to return to.

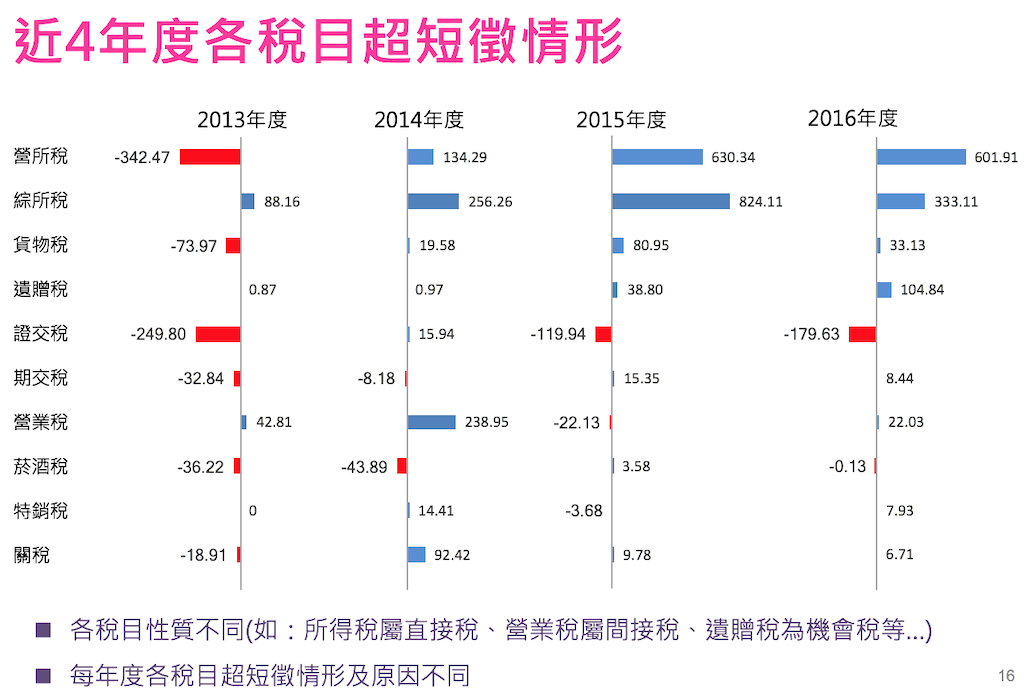

And the "super-signal red envelope" mentioned in the sponsor's copy, the Ministry of Finance explained that according to the fiscal revenue and expenditure division method, a certain proportion of the national tax revenue belongs to the local government. Therefore, before accounting for the central government's revenue, these taxes have been allocated to local governments in a fixed proportion. Only the distribution at the beginning and the middle of the year is allocated according to the estimated value. By the end of the year, since there are already the final accounts of the tax, they will be distributed according to the final accounts of the tax. If there is an over-levy in the year, the amount of the distribution will be higher. The media will be called the “extra red envelope”, but in fact these values are the established distribution according to the law, and the tax amount after the distribution is counted in the central government. Years of entry. In the follow-up report, Mr. Chen Guoliang pointed out that there are many reasons for the over-levera. It is very likely that the Ministry of Finance has short-evaluated some values in order to better meet the standards. He suggested that the Ministry of Finance should not use the term "super-levy" in the future. So as not to cause misunderstandings. He suggested that the Ministry of Finance should continue to review the reasons for the short-term assessment in the future, or use the interval to predict the annual revenue for the year.

However, the statement from the Ministry of Finance did not seem to let the participants of the meeting understand. Although the participants agreed that the definition of over-levy is the same as that of the Ministry of Finance, after the Ministry of Finance reports, the second party continues to question the continuation of the Ministry of Finance over the years is an illegal and inefficient performance, questioning the amount of over-levy may not be properly reviewed in the Legislative Yuan. The situation is illegally used. After the convergence of the host team, the views of the second party were clarified.

The second person believes that the super-levy is due to the illegal taxation of the Ministry of Finance

The second party believes that the excessive levy of the Ministry of Finance for many years is illegal and inefficient, and further they questioned It may be because the Ministry of Finance encourages taxpayers to tax illegally with tax incentives. These illegal taxes have led to the death of some people, and some industries have left. They believe that the amount of the super-levy is illegally used to issue tax incentives, and it is questioned that some tax incentives may become illegal gains. The proponents believe that Taiwan’s economy has been sluggish for years. It should be returned to the public with these over-levied funds to stimulate domestic demand and promote economic development.

The Ministry of Finance responded that all taxes are taxed according to law. If there is a situation of illegal taxation, the government can use the relief channel, or it can be judged by the judge in the administrative court; tax incentives Some of them have already been answered in the previous proposal, and today I hope to focus on the discussion of the super-levy. As for promoting economic development, according to Chen’s report, if it is to promote economic development, expanding public spending may be more effective than returning to the public.

The two sides exchanged fires several times, and it is difficult for the collaborative meeting to enter the afternoon group discussion. Under the limited time, only the two sides can be sorted out (https://realtimeboard.com/app/board/o9J_kz3AqVk=/), provide a follow-up reference. At the end of the meeting, Lai Zhixiang of the Tang Feng Political Commissar Office stated that the results of the collaborative meeting will be referenced by the political commissar to the president and relevant heads of the relevant ministries in the government meeting as a reference for follow-up policy planning.

There was no consensus at the meeting, and the participants still insisted on the original view

Although there were many exchanges of fire between the two parties at the meeting, the presenters at the meeting still believed that the meeting had more explanations and focus, and thank you. The host team gathered their views. They believe that the officials of the Ministry of Finance can participate in the meeting is a sincere display, but perhaps there is a bigger conspiracy behind them to blind the officials.

The second party believes that because of the previous election, it will be said that the referendum on over-tax refund will require a public hearing to clarify the issue, there may be people at the meeting who confuse the public hearing with this collaborative meeting. The second installers believe that the Ministry of Finance's explanations are still unclear. I still hope that the part of fiscal discipline can be improved. I also hope that Taiwan's economy can grow again through tax rebates.

(This work is licensed under a Creative Commons Attribution 4.0 International License.)

(This work is licensed under a Creative Commons Attribution 4.0 International License.)